- This topic is empty.

-

Topic

-

Private equity refers to a form of investment that involves investing in privately held companies or assets that are not publicly traded on a stock exchange. Private equity firms raise capital from various sources, such as institutional investors, high-net-worth individuals, and pension funds, and then use this capital to acquire, invest in, or provide financing for companies that are not listed on public stock exchanges.

The goal of private equity is typically to achieve high returns by actively managing and growing the companies in which they invest. Private equity firms often take a significant ownership stake in the companies they acquire, giving them a substantial level of control and influence over the business operations.

The life cycle of a private equity investment typically involves several stages:

- Fundraising: Private equity firms raise funds from investors for a specified investment period, usually around 10 years.

- Deal Sourcing and Evaluation: Private equity firms identify potential investment opportunities and conduct thorough due diligence to assess the financial health, growth potential, and risks associated with a target company.

- Acquisition: Once a suitable target is identified, the private equity firm acquires a significant ownership stake in the company, often taking it private.

- Operational Improvement: Private equity firms actively work with the management of the acquired company to implement operational improvements, strategic initiatives, and cost-cutting measures to enhance the company’s value.

- Exit: The ultimate goal is to sell or exit the investment at a profit. This can be achieved through various means, such as selling the company to another company, conducting an initial public offering (IPO), or selling to another private equity firm.

Private equity investments are known for their longer investment horizon compared to other types of investments. They involve a higher level of hands-on management and strategic involvement by the private equity firms. While private equity can provide substantial returns, it also involves higher risks and requires a longer time horizon for investors.

Steps:

- Fundraising:

- Private equity firms begin by raising capital from institutional investors, such as pension funds, endowments, and high-net-worth individuals.

- The funds raised are pooled into a private equity fund with a specific investment strategy.

- Deal Sourcing:

- Firms identify potential investment opportunities through various channels, including proprietary networks, investment banks, and industry contacts.

- The goal is to find companies that fit the fund’s investment criteria and strategy.

- Due Diligence:

- In-depth due diligence is conducted on the target company to assess its financial health, operations, market position, management team, and potential risks.

- Legal, financial, and operational aspects are thoroughly examined during this phase.

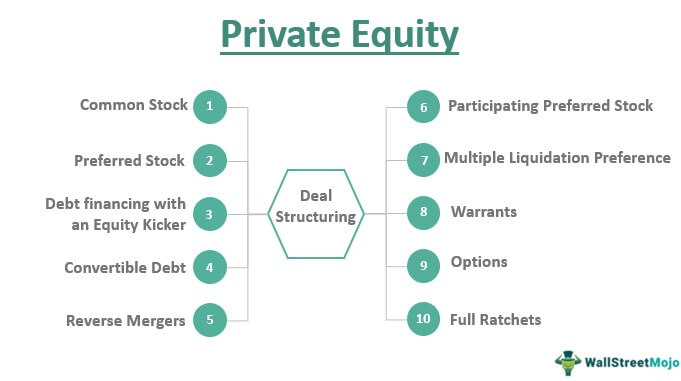

- Deal Structuring:

- Negotiations take place to determine the terms of the investment, including the valuation, ownership stake, governance structure, and any conditions or covenants.

- The deal structure may involve acquiring a controlling or minority stake in the target company.

- Investment:

- Once the terms are agreed upon, the private equity firm makes the investment, often taking an active role in the management and strategic decisions of the company.

- The investment may involve providing capital for growth, acquisitions, or operational improvements.

- Operational Improvement:

- Private equity firms work closely with the management team of the portfolio company to implement strategic initiatives and operational improvements.

- Efforts may include cost-cutting measures, expansion into new markets, or improvements in corporate governance.

- Monitoring and Value Creation:

- The private equity firm actively monitors the performance of the portfolio company throughout the investment period.

- Strategies are implemented to enhance the company’s value and position it for a successful exit.

- Exit Planning:

- Private equity firms develop an exit strategy to realize returns for investors. Common exit options include selling to another company, conducting an IPO, or selling to another private equity firm.

- The exit strategy is often planned in alignment with the fund’s investment horizon, which typically ranges from three to seven years.

- Exit Execution:

- The chosen exit strategy is executed, and the private equity firm sells its ownership stake in the portfolio company.

- Profits from the exit are distributed among the fund’s investors, with the private equity firm typically receiving a share of the profits as carried interest.

- Fund Closure or Repeat:

- After successfully exiting investments, the private equity fund may be closed, and remaining funds are distributed to investors.

- Some private equity firms may choose to raise a new fund and repeat the investment process.

Advantages

- Active Management and Operational Improvement:

- Private equity firms often take a hands-on approach to managing and improving the performance of the companies in their portfolios. This active management can lead to operational efficiencies, strategic initiatives, and better overall business performance.

- Long-Term Investment Horizon:

- Investments typically have a longer time horizon compared to public market investments. This longer-term perspective allows for strategic planning, implementation of growth initiatives, and value creation over several years.

- Access to Capital:

- Private equity provides companies with access to substantial capital that can be used for various purposes, including expansion, research and development, acquisitions, and debt reduction.

- Expertise and Industry Knowledge:

- Firms often specialize in specific industries, bringing deep industry knowledge and expertise to the companies they invest in. This specialized knowledge can be valuable for strategic decision-making and navigating industry challenges.

- Alignment of Interests:

- They typically invest their own capital alongside that of their investors. This alignment of interests ensures that the private equity firm is motivated to generate strong returns, as they share in the financial success of the investment.

- Flexibility in Capital Structure:

- Investments can involve a combination of equity and debt financing. This flexibility allows for the optimization of the capital structure to meet the specific needs and opportunities of the portfolio company.

- Strategic Guidance and Networking:

- Often provide strategic guidance to the management teams of portfolio companies. Additionally, portfolio companies may benefit from the extensive networks and relationships that private equity firms have, facilitating potential partnerships, collaborations, or customer relationships.

- Risk Diversification for Investors:

- Can provide institutional investors with a way to diversify their portfolios. Since private equity returns are not always correlated with public market returns, they can serve as a diversification strategy.

- Potential for High Returns:

- Have the potential to generate high returns, especially if the private equity firm is successful in implementing operational improvements and successfully exiting investments at a profit.

- Support for Management Succession:

- Private equity firms can assist in planning for and executing management succession strategies within portfolio companies, ensuring a smooth transition and continuity of leadership.

Disadvantages

- Lack of Liquidity:

- Private equity investments are illiquid, meaning that investors typically cannot easily sell their ownership stakes. The capital is usually tied up for the duration of the investment, which can range from several years to over a decade.

- High Risk and Volatility:

- Investments can be riskier than publicly traded securities. The success of the investment is often tied to the operational performance and market conditions, and there is a higher risk of business failure, especially in industries with rapid technological changes or economic downturns.

- Long Investment Horizon:

- The extended investment holding period in private equity may not be suitable for all investors, particularly those seeking short-term returns or needing liquidity within a shorter timeframe.

- Limited Investor Control:

- Investors in private equity funds have limited control over the day-to-day operations and strategic decisions of the portfolio companies. The active management role is typically held by the private equity firm.

- Fee Structure:

- Funds often charge management fees and performance-based fees, such as carried interest. While these fees align the interests of the fund manager with those of investors, they can also reduce overall returns for investors.

- Complex Investment Structures:

- Transactions can involve complex financial structures, including a mix of equity and debt financing. These structures may result in increased financial complexity and potential challenges in valuation.

- Dependency on Management Competence:

- The success of a private equity investment relies heavily on the competence of the management team in both the private equity firm and the portfolio company. If the management team fails to execute the planned strategies, the investment may underperform.

- Regulatory and Compliance Risks:

- Private equity investments may be subject to changing regulatory environments, and compliance with various regulations can be challenging. Changes in tax laws, for example, can impact the financial performance of investments.

- Difficulty in Exiting Investments:

- Economic conditions or unforeseen challenges may make it difficult to execute planned exit strategies. This can delay the return of capital to investors and impact overall fund performance.

- Impact on Company Culture:

- The aggressive cost-cutting measures or strategic changes implemented by private equity firms to improve operational efficiency may sometimes lead to cultural clashes and employee dissatisfaction within portfolio companies.

Examples

- Leveraged Buyouts (LBOs):

- One common type of private equity investment is the leveraged buyout, where a private equity firm acquires a controlling stake in a company using a significant amount of borrowed funds. An example is the acquisition of Hertz by a group of investors led by private equity firms in 2005.

- Venture Capital Investments:

- Venture capital is a form of private equity that focuses on investing in early-stage and high-growth startups. Examples include Sequoia Capital’s investment in companies like Google and Apple during their early stages.

- Growth Equity Investments:

- Private equity firms may invest in companies that have already demonstrated a level of success but need capital for expansion. For instance, General Atlantic invested in Airbnb to support its global expansion.

- Distressed Debt Investments:

- Firms may specialize in distressed investing, acquiring the debt of struggling companies or buying distressed assets. An example is the acquisition of Energy Future Holdings by a consortium of private equity firms.

- Infrastructure Investments:

- Some of them focus on infrastructure investments, such as the acquisition of infrastructure assets like airports, toll roads, or utilities. Global Infrastructure Partners (GIP) is an example of a private equity firm involved in infrastructure investments.

- Healthcare Investments:

- Active in the healthcare sector, investing in companies that provide healthcare services, pharmaceuticals, or medical technology. The acquisition of Quintiles by private equity firm Hellman & Friedman is an example.

- Technology Investments:

- Firms often invest in technology companies. Silver Lake’s investment in Dell Technologies is an example of a significant private equity transaction in the technology sector.

- Consumer Goods Investments:

- May invest in companies producing consumer goods. An example is the acquisition of The Campbell Soup Company’s international business by KKR.

- Real Estate Investments:

- Have real estate investment arms, investing in commercial and residential properties. Blackstone, one of the largest private equity firms globally, is involved in real estate investments.

- Secondary Market Transactions:

- Private equity firms may engage in secondary market transactions, buying and selling existing private equity fund interests. This can involve the acquisition of portfolios of companies. Coller Capital is an example of a firm active in the secondary market.

- You must be logged in to reply to this topic.