- This topic is empty.

-

Topic

-

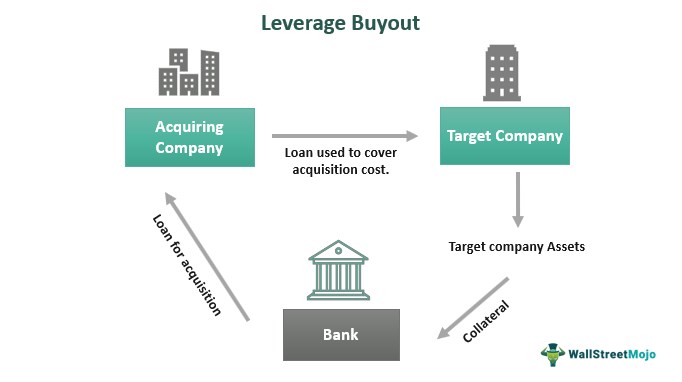

A Leveraged Buyout (LBO) is a financial transaction in which a company is acquired using a significant amount of borrowed money to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The buyer (often a private equity firm) uses a combination of equity and debt to finance the purchase.

LBOs are commonly used by private equity firms as a strategy to acquire companies, enhance their performance, and eventually sell them for a profit. However, the high level of debt involved in LBOs also means they can be risky, as the success of the investment is closely tied to the ability of the acquired company to generate enough cash flow to service its debt obligations.

Steps:

- Deal Origination:

- This phase involves identifying potential target companies for acquisition. Private equity firms, investment banks, or corporate acquirers may actively search for suitable candidates.

- Initial Screening:

- Once potential targets are identified, a preliminary assessment is conducted to evaluate their financial performance, growth potential, industry dynamics, and other relevant factors.

- Due Diligence:

- In-depth due diligence is performed on the target company. This involves a comprehensive examination of its financial statements, operations, management team, legal and regulatory compliance, and any potential risks or liabilities.

- Deal Structuring:

- Based on the due diligence findings, the acquiring entity structures the deal, determining the amount of debt and equity required for the acquisition. This involves estimating the target company’s enterprise value, negotiating the purchase price, and deciding on the financing mix.

- Financing Arrangements:

- The acquiring entity secures financing for the LBO. This typically involves obtaining debt from various sources, such as banks, financial institutions, or the bond market. Equity financing is provided by the acquiring company or a private equity fund.

- Letter of Intent (LOI) and Negotiation:

- A Letter of Intent is issued, outlining the key terms and conditions of the proposed transaction. Negotiations take place to finalize the deal structure, price, and other important aspects.

- Definitive Agreements:

- Once negotiations are successful, definitive agreements are drafted and signed. These may include a Purchase Agreement, Shareholders’ Agreement, and other legal documents that formalize the terms of the acquisition.

- Closing:

- The actual acquisition takes place on the closing date. This involves the transfer of ownership and the payment of the purchase price. The acquiring entity gains control of the target company.

- Post-Acquisition Integration:

- After the acquisition, the acquiring entity works on integrating the target company into its operations. This may involve restructuring, implementing operational improvements, and aligning strategic goals.

- Operational Improvements:

- The private equity firm or acquiring entity implements strategies to enhance the operational efficiency and profitability of the acquired company. This may include cost-cutting measures, improving management practices, or entering new markets.

- Exit Strategy:

- The final step is to realize the return on investment. The private equity firm decides on the best exit strategy, which may involve selling the company to another entity, conducting an IPO, or merging it with another business.

Advantages

- Potential for High Returns:

- LBOs have the potential to generate high returns on investment. By using a significant amount of debt to finance the acquisition, the equity investors can amplify their returns if the acquired company performs well.

- Enhanced Management Focus:

- Private equity firms often bring experienced management teams to the companies they acquire through LBOs. This can lead to a more focused and strategic approach to business operations, with an emphasis on improving efficiency and profitability.

- Alignment of Interests:

- In an LBO, the management team of the acquired company is often given an equity stake in the business. This aligns the interests of management with those of the private equity firm, creating an incentive for the team to work towards the company’s success and value creation.

- Financial Engineering Opportunities:

- LBO structures allow for financial engineering, including the use of tax shields such as interest expense deductions on the debt. This can contribute to the overall financial efficiency of the transaction.

- Flexible Exit Strategies:

- Private equity firms have various exit options after acquiring a company through an LBO. They can sell the company to another entity, take it public through an IPO, or merge it with another business. This flexibility allows them to choose the most favorable exit strategy based on market conditions and the performance of the acquired company.

- Improved Corporate Governance:

- Firms often implement stronger corporate governance practices in the companies they acquire. This can lead to better decision-making processes, improved transparency, and increased accountability.

- Unlocking Value through Operational Improvements:

- They actively work to enhance the operational efficiency of the acquired company. This may involve implementing cost-cutting measures, improving management practices, and optimizing business processes to unlock value and improve profitability.

- Access to Capital Markets:

- Provide companies with access to capital markets, allowing them to raise funds for growth initiatives or debt refinancing. This access to additional capital can contribute to the long-term success of the acquired company.

- Portfolio Diversification for Investors:

- For investors in private equity funds, LBOs offer a way to diversify their portfolios. By participating in a fund that engages in a variety of LBO transactions across different industries, investors can spread risk and potentially enhance overall returns.

Disadvantages

- High Levels of Debt:

- One of the primary characteristics of LBOs is the use of a significant amount of debt to finance the acquisition. High levels of debt increase the financial risk, and if the acquired company fails to generate sufficient cash flow to service the debt, it could lead to financial distress.

- Interest Rate Risk:

- LBOs are sensitive to changes in interest rates. If interest rates rise after the acquisition, the cost of servicing the debt increases, potentially impacting the financial viability of the deal.

- Financial Market Conditions:

- Are influenced by financial market conditions, including the availability of debt financing. During periods of economic downturns or credit market tightness, obtaining favorable financing terms can be challenging, affecting the feasibility of the transaction.

- Market and Economic Risk:

- The success of an LBO often depends on the overall economic and market conditions. Economic downturns or industry-specific challenges can adversely impact the performance of the acquired company, affecting the returns on investment.

- Operational Challenges:

- Implementing operational improvements in the acquired company may be more challenging than anticipated. Market dynamics, competition, and unforeseen operational issues can hinder the ability to achieve the desired efficiencies and improvements.

- Lack of Liquidity:

- Private equity investors in LBOs typically have a longer investment horizon, and exit opportunities may not materialize as quickly as anticipated. This lack of liquidity can be a disadvantage for investors seeking shorter-term returns.

- Management Turnover:

- The changes introduced by private equity firms in the management and operations of the acquired company may lead to disruptions and key personnel turnover, which could impact the company’s performance.

- Market Timing Risk:

- The success of an LBO can be influenced by the timing of the acquisition and the subsequent exit. If the market conditions are unfavorable during the exit period, it may be challenging to achieve the desired returns.

- Regulatory and Legal Risks:

- LBO transactions are subject to regulatory scrutiny and may face legal challenges. Changes in regulations or unexpected legal issues can impact the progress and success of the deal.

- Cyclical Industries:

- Companies in cyclical industries are particularly vulnerable to economic downturns. If the acquired company operates in a sector with inherent cyclical risks, the performance of the business may be more volatile.

Examples

- RJR Nabisco (1988):

- Often considered one of the largest and most famous LBOs, the acquisition of RJR Nabisco by Kohlberg Kravis Roberts & Co. (KKR) in 1988 involved a bidding war and a final deal valued at around $25 billion. The transaction was later chronicled in the book “Barbarians at the Gate.”

- HCA (2006):

- Hospital Corporation of America (HCA), one of the largest hospital operators in the U.S., went private in a $33 billion LBO led by Bain Capital, Kohlberg Kravis Roberts (KKR), and Merrill Lynch Global Private Equity in 2006.

- Dell Inc. (2013):

- Michael Dell, in partnership with Silver Lake Partners, took personal computer manufacturer Dell Inc. private in a deal valued at approximately $24.4 billion. The transaction aimed to facilitate the company’s transition away from the public markets.

- TXU Corp (2007):

- In 2007, Kohlberg Kravis Roberts (KKR) and TPG Capital led a consortium of investors in the acquisition of TXU Corp (Texas Utilities) in a deal valued at about $45 billion. The buyout was significant in the energy sector.

- Clear Channel Communications (2008):

- Bain Capital and Thomas H. Lee Partners acquired Clear Channel Communications, a major media company, in a deal valued at around $17.9 billion in 2008.

- Alliance Boots (2007):

- Kohlberg Kravis Roberts (KKR) and Stefano Pessina took Alliance Boots private in a deal worth around £11.1 billion, making it one of the largest LBOs in Europe at the time.

- Dunkin’ Brands (2005):

- In 2005, Dunkin’ Brands, the parent company of Dunkin’ Donuts and Baskin-Robbins, was acquired by a consortium of private equity firms, including Bain Capital, The Carlyle Group, and Thomas H. Lee Partners, for about $2.4 billion.

- Hertz Global Holdings (2005):

- Hertz, the car rental company, went private in 2005 through a $15 billion LBO led by Clayton, Dubilier & Rice, The Carlyle Group, and Merrill Lynch Global Private Equity.

- Deal Origination:

- You must be logged in to reply to this topic.